Global X Copper Miners ETF (ASX: WIRE) closed at $24.93 per unit yesterday, up 0.12%, and hit a record of $25.92 on Tuesday.

This ASX ETF is having a tremendous run on the back of rising global demand for copper.

The copper price soared 42% in 2025 and hit a new record above US$6 per pound last week.

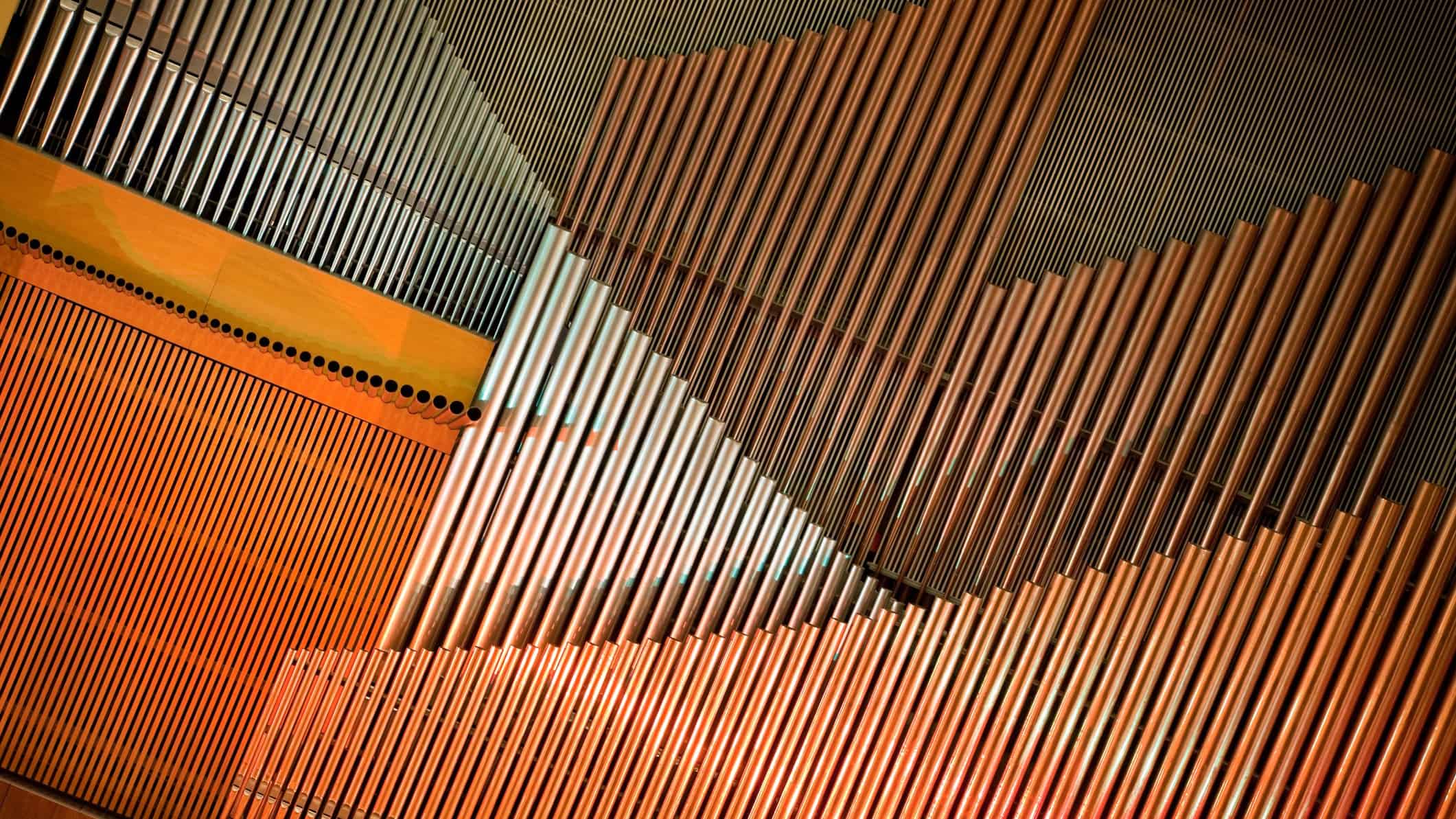

Copper is essential for electrification and is a key ingredient in much of the new infrastructure being built for the green energy transition.

It offers high ductility, malleability, and thermal and electrical conductivity, and is resistant to corrosion.

Copper is used in wiring, electric vehicles (EVs), wind turbines, solar energy systems, telecommunications, and electronic products.

The red metal was added to the US Critical Minerals List in November 2025.

Surging demand for copper has provided tremendous support to ASX copper shares, as well as two of our diversified major miners.

The market’s largest pure-play copper share, Sandfire Resources Ltd (ASX: SFR), reached a record $19.61 per share yesterday.

Develop Global Ltd (ASX: DVP) shares also hit a record high of $5.46 this week.

Capstone Copper Corp CDI (ASX: CSC) shares reached a record of $15.89 last week.

The Aeris Resources Ltd (ASX: AIS) share price rose to a two-year high of 68 cents last week, too.

Shares in BHP Group Ltd (ASX: BHP), the world’s largest producer, hit a 52-week high of $49.75 yesterday.

Rio Tinto Ltd (ASX: RIO), which began life 150 years ago as a copper miner in Spain, hit a record $154.75 per share last week.

All these price milestones bode well for WIRE ETF, which invests in most of these ASX copper stocks.

BHP shares make up 4% of investments and Sandfire Resources comprises about 3.2%.

Capstone Copper provides another 3%, and Develop Global makes up 0.36%.

What is $10,000 invested a year ago now worth?

On 16 January 2025, WIRE ETF closed at $12.91 apiece.

If you had put $10,000 into this ASX ETF then, it would have bought you 774 units (for $9,992.34).

There’s been capital growth of $12.02 per unit since then, which equates to $9,303.48.

Therefore, your $10,000 investment in WIRE ETF a year ago would be worth $19,295.82 today.

Woah.

Total returnsâ¦

WIRE ETF also pays dividends (called ‘distributions’ with ETFs).

Global X paid 14.29 cents per unit in July 2025 and will pay 6.21 cents per unit today.

So, you will have received $158.67 in income over the past year.

Your capital gain of $9,303.48 plus your distributions of $158.67 gives you a total annual return, in dollar terms, of $9,462.15.

Remember, you invested $9,992.34 in WIRE this time last year.

This means you have received a total return, in percentage terms, of 95% over 12 months.

Ripper!

The post $10,000 invested in WIRE ETF a year ago is now worth⦠appeared first on The Motley Fool Australia.

Should you invest $1,000 in Global X Copper Miners ETF right now?

Before you buy Global X Copper Miners ETF shares, consider this:

Motley Fool investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Global X Copper Miners ETF wasn’t one of them.

The online investing service he’s run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

And right now, Scott thinks there are 5 stocks that may be better buys…

* Returns as of 1 Jan 2026

.custom-cta-button p {

margin-bottom: 0 !important;

}

More reading

- Here are the top 10 ASX 200 shares today

- Fortescue shares vs. BHP: Which delivered superior returns in 2025?

- Why BHP, BlueScope, Catalyst Metals, and Ryman shares are storming higher today

- 5 ASX 200 mining stocks including Mineral Resources and BHP shares smashing new 52-week highs today

- 5 things to watch on the ASX 200 on Thursday

Motley Fool contributor Bronwyn Allen has positions in BHP Group and Global X Copper Miners ETF. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has recommended BHP Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

Leave a Reply