This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

If you’ve been keeping up with the tech industry, you’ve witnessed artificial intelligence (AI) go from a niche topic to the hottest theme in business. It’s almost inescapable at this point. Many businesses have benefited from the AI boom, but maybe none more so than Nvidia (NASDAQ: NVDA).

The chipmaker’s stock is up by more than 160% this year alone, continuing a rally that has seen its stock price increase by more than 760% in the past year and a half. It even briefly took the title of the “world’s most valuable public company,” passing tech titans Microsoft and Apple.

Nvidia’s run has been remarkable, there’s no doubt. However, with so many investors rushing to buy the stock, others are wondering whether the hype has pushed it into bubble territory.

How did Nvidia get to this point?

Nvidia is known for its graphic processing units (GPUs) — blazing-fast parallel processors that are among the best hardware available for providing the computational power necessary to train and deploy AI models. According to some estimates, the company recently held as large as a 95% share of the AI chip market, so to say it’s important to the AI pipeline would be an understatement.

There’s also the data center aspect. Data centers are the foundation of AI infrastructure, providing the computational power needed to process and analyze massive amounts of data. Without that ability, there’s no AI as we know it.

Most of the companies that run these data centers have built them using massive volumes of Nvidia’s GPUs — among them, major cloud platform providers Amazon, Microsoft, and Alphabet. Their unprecedented demand for Nvidia’s AI-related hardware has put the company on a whole new trajectory.

Its earnings from the first quarter were beyond impressive

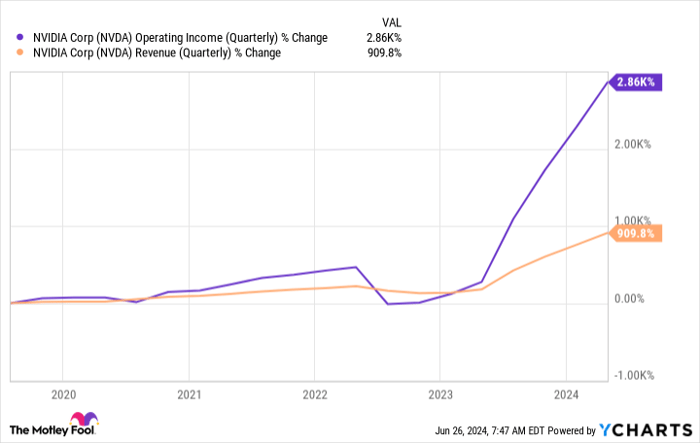

Nvidia’s financials have soared due to the unprecedented demand. In its fiscal 2025 first quarter, which ended April 30, the company reported year-over-year gains that most large companies can only dream about.

Its revenue increased 262% to $26 billion, led by a 427% increase in data center revenue of $22.6 billion (both company records). Arguably more impressive, though, was the 690% jump in operating income to $16.9 billion. And its gross margin went from 64.6% to 78.4% — not too shabby.

NVDA Operating Income (Quarterly) data by YCharts.

Nvidia is surely benefiting from increased demand for its chips, but an underrated upside of being the undisputed leader in the space is the pricing power that comes with it. With demand continuing to outstrip supply, Nvidia should be able to charge premium prices and maintain its impressive margins.

To say the stock is expensive would be an understatement

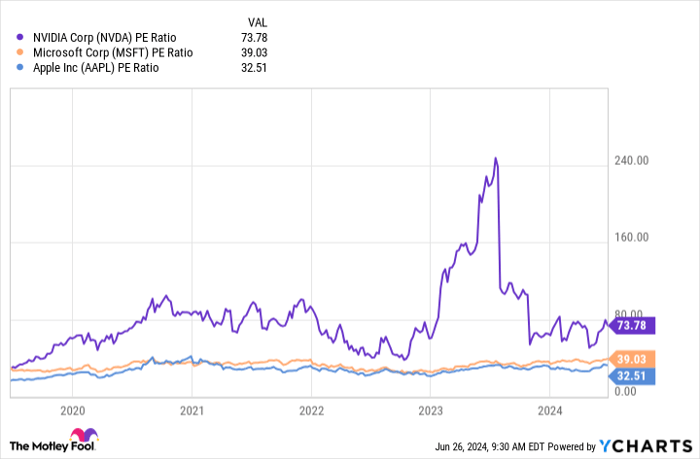

Nvidia’s financials have been impressive, but the stock is one of the most expensive on the market. The surge in earnings has brought its valuation down to a more reasonable level than the roughly 240 price-to-earnings ratio it had last year, but it’s still high. Just look at how it compares to tech giants Microsoft and Apple.

NVDA PE Ratio data by YCharts.

A high valuation can be justified when the company’s growth prospects match it, but at some point, even the most promising companies can reach valuations that go beyond what’s fundamentally reasonable.

In Nvidia’s case, many investors are rushing to buy the stock because of a fear of missing out. This happens with virtually every promising new technology. The problem is that much of the run-up is built on speculation, and with that comes an increased risk of a sharp correction if investors’ expectations aren’t met.

Is Nvidia a great company? Absolutely. But is it fair to say its stock is flirting with bubble territory? I would certainly say yes.

Slow and steady often wins the race

Nobody can reliably predict what the stock market will do in the near term, nor know if Nvidia or the AI sector as a whole are in bubbles destined to pop. You can look to history as an indicator, but nobody can say for certain. That’s why I believe the best approach to Nvidia’s stock now is to dollar-cost average your way into a stake.

When you dollar-cost average, you decide on a specific amount you can commit to investing and then set a regular schedule to make those investments. For example, you might commit to investing $400 monthly into Nvidia. From there, it’s up to you to decide if you want to divide the investments into four $100 weekly investments, two $200 bi-weekly investments, or whatever works best for you. Sticking to your schedule is more important than whatever frequency you choose.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The post Nvidia’s stock is up 160% in 2024, but is it a bubble waiting to pop? appeared first on The Motley Fool Australia.

Should you invest $1,000 in Nvidia right now?

Before you buy Nvidia shares, consider this:

Motley Fool investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Nvidia wasn’t one of them.

The online investing service heâs run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

And right now, Scott thinks there are 5 stocks that may be better buys…

See The 5 Stocks *Returns as of 24 June 2024

More reading

- Can Nvidia stock cross $1,000 again after the stock split?

- One day, Nvidia stock will go down. Here’s how to keep it from hurting your portfolio

- Where will Nvidia stock be in 10 years?

- Nvidia is no longer the most valuable company in the world. Here’s what investors need to know

- Where are we in the share market cycle?

Suzanne Frey, an executive at Alphabet, is a member of The Motley Foolâs board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Foolâs board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has recommended the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool Australia has recommended Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

Leave a Reply