Amongst the ASX dividend shares typically chosen by income-seeking investors on the ASX, Transurban Group (ASX: TCL) shares are a perennially popular choice.

Alongside the major ASX banks like Commonwealth Bank of Australia (ASX: CBA), BHP Group Ltd (ASX: BHP), and Telstra Group Ltd (ASX: TLS), Transurban is often bought for its income potential for those investors seeking to build up a stream of passive income to one day retire on.

However, Transurban is a rather unique ASX share in the top echelons of the ASX. So today, let’s discuss this company and what kind of role it can play in a dividend portfolio in 2026 and beyond.

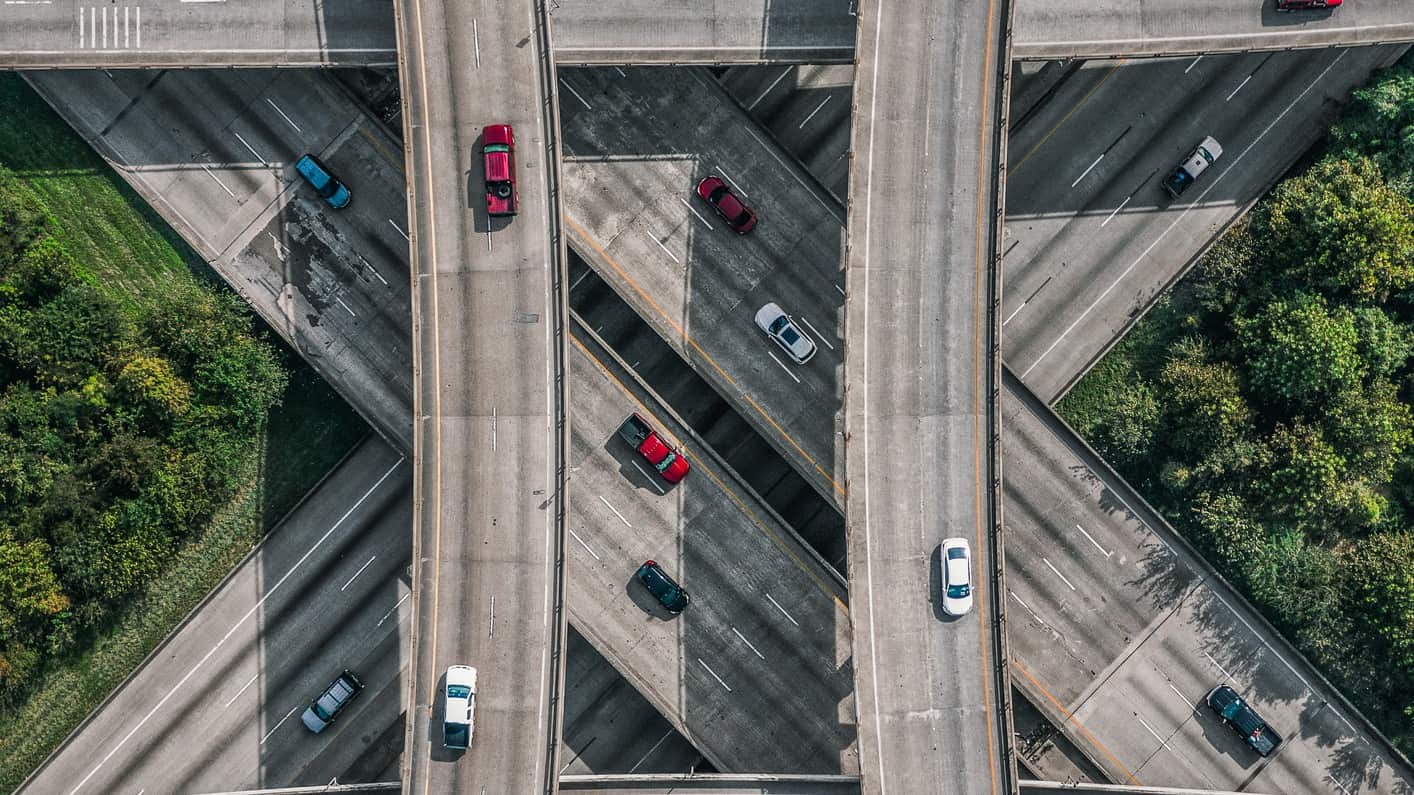

If you weren’t aware, Transurban is a toll-road operator. It has extensive operations across Australia, owning many (if not most) of the major tolled arterial roads in Sydney, Melbourne, and Brisbane. It also owns roads in North America. In Sydney alone, Transurban operates no fewer than 11 motorways, meaning motorists in Australia’s largest city are very familiar with doing business with this company.

It’s largely due to this business model that ASX dividend investors are so attracted to Transurban shares.

Transurban shares: An ASX dividend favourite

Road traffic is highly predictable and relatively insensitive to what happens in the broader economy. As such, it is a lucrative and reliable source of revenue for Transurban.

The company has decades-long contracts covering most of its roads, many of which allow Transurban to increase its tolls every quarter by at least the rate of inflation (usually by more).

This translates into a dependable dividend for income investors. Prior to the 2020 pandemic, Transurban was famous for increasing its annual dividend almost every year. The disruption of the pandemic did (understandably) dent this company’s payouts.

But since 2021, the company’s dividends have been increasing annually. 2025 saw the company pay out a 32-cent per share dividend in February. That was followed by a 33-cent-per-share payout in August. Both payments represented increases over their 2024 equivalents.

At today’s (at the time of writing) share price of $14.94, these dividends give Transurban shares a trailing dividend yield of 4.35%.

There is one major caveat to note with this company, though. Due to its unique business model, Transurban does not normally attach significant franking credits to its dividends.

To illustrate, February’s dividend came completely unfranked, while August’s payout was partially franked but at just 0.05%.

Foolish Takeaway

Considering the hefty upfront yield and steady track record, I regard Transurban shares as a useful source of income and worthy of a place in a diversified, dividend-focused portfolio. However, this is not a growth stock. As such, someone looking to beat the market over the long term might want to look elsewhere.

The post Are Transurban shares a buy for dividend income right now? appeared first on The Motley Fool Australia.

Should you invest $1,000 in Transurban Group right now?

Before you buy Transurban Group shares, consider this:

Motley Fool investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Transurban Group wasn’t one of them.

The online investing service he’s run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

And right now, Scott thinks there are 5 stocks that may be better buys…

* Returns as of 18 November 2025

.custom-cta-button p {

margin-bottom: 0 !important;

}

More reading

- 3 ASX dividend machines I think will keep paying for decades

- 3 ultra-reliable ASX dividend stocks I’d buy for long-term income

- No savings at 55? Here’s how to still retire with passive income

- These top ASX dividend stocks offer 5% yields

- 2 of the best ASX dividend shares to buy for dependable passive income

Motley Fool contributor Sebastian Bowen has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has positions in and has recommended Transurban Group. The Motley Fool Australia has positions in and has recommended Telstra Group and Transurban Group. The Motley Fool Australia has recommended BHP Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

Leave a Reply