ASX copper shares surged today amid the commodity price ripping more than 6% higher to above US$6.30 per pound — a new record.

Copper is benefiting from rising demand for real assets amid geopolitical and trade uncertainties and a rapidly falling US dollar.

Today, the Australian dollar is trading at 71 US cents, a three-year high.

Trading Economics analysts explained why copper rose so strongly today:

In recent developments, US President Donald Trump threatened Iran with military strikes far more severe than the attack he ordered in June unless the country agrees to a trade deal with Washington.

Trump’s tariff threats against other nations, coupled with his apparent indifference to the dollar’s weakness, further fueled the flight to metals.

Copper is also being supported by recurring supply tightness and robust industrial demand, particularly driven by the global transition to renewable energy and artificial intelligence.

Meanwhile, copper inventories in Shanghai, London, and New York have risen in recent weeks, pushing combined holdings above 900,000 tons.

Copper is in high demand as the green energy transition begins showing its impact in strongly rising commodity prices.

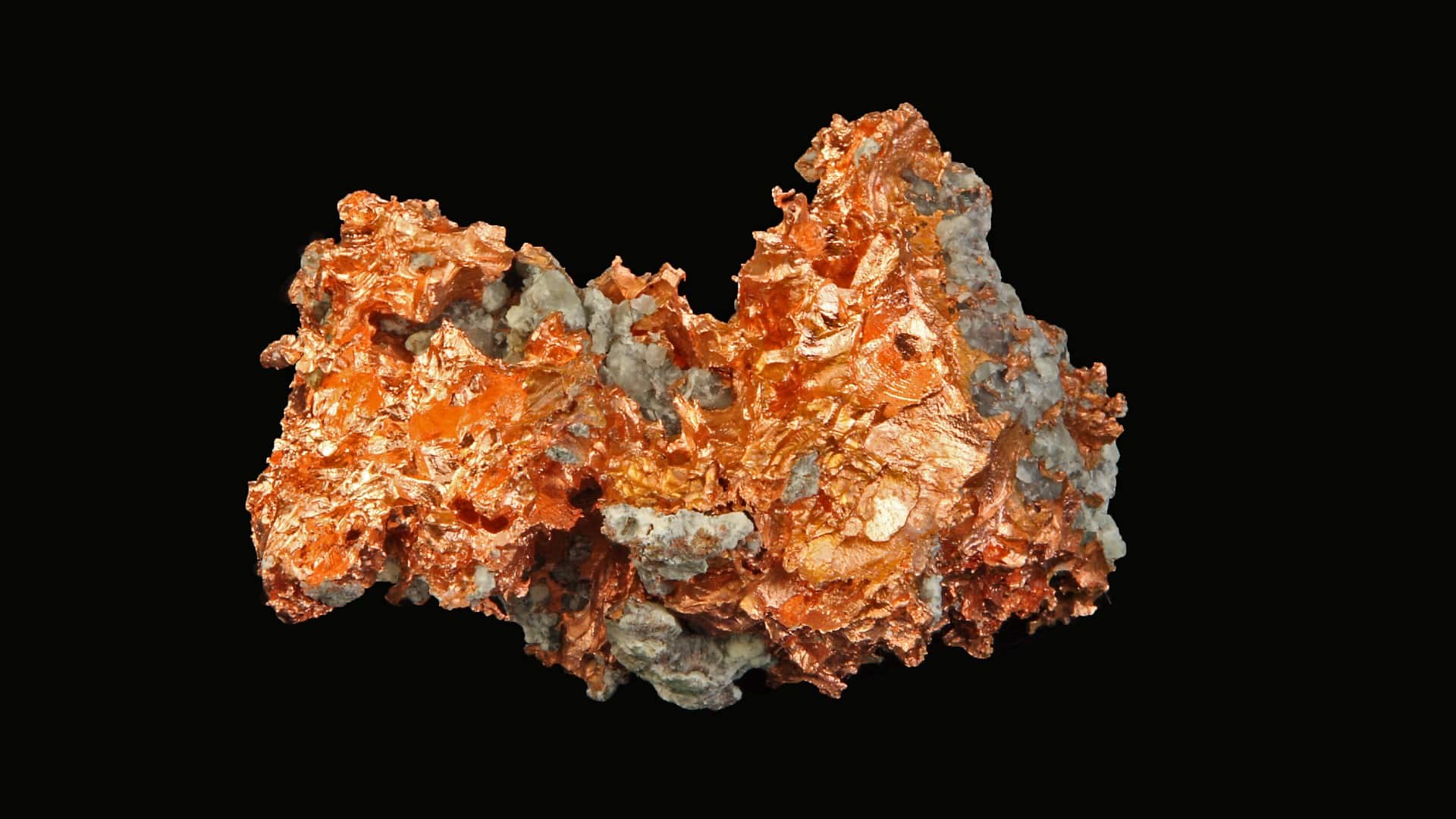

The red metal is essential for electrification.

It is a key input in much of the new infrastructure required for the energy transition and artificial intelligence systems.

It offers high ductility, malleability, and thermal and electrical conductivity, and is resistant to corrosion.

Copper is in wiring, electric vehicles (EVs), wind turbines, solar energy systems, telecommunications, and electronic products.

The US added the red metal to its Critical Minerals List in November.

What happened with ASX copper shares today?

BHP Group Ltd (ASX: BHP), now the world’s largest copper producer, rose 2.1% to a two-year high of $51.66 per share.

The Rio Tinto Ltd (ASX: RIO) share price ascended 1.6% to a record $157.24.

The ASX 200’s largest pure-play copper share Sandfire Resources Ltd (ASX: SFR) reached a record $21.30, up 5.2%.

Capstone Copper Corp CDI (ASX: CSC) shares soared 5.1% to a record $17.64 per share.

Aeris Resources Ltd (ASX: AIS) shares lifted 2.9% to a 52-week high of 70 cents.

The Develop Global Ltd (ASX: DVP) share price rose 2.2% to $5.65.

ASX exchange-traded fund (ETF) Global X Copper Miners ETF (ASX: WIRE) lifted 7.8% to a record $28.95.

However, not all ASX copper shares were buoyed by the commodity’s surge today.

The Greatland Resources Ltd (ASX: GGP) share price fell 0.86% to $13.77.

WA1 Resources Ltd (ASX: WA1) shares fell 2.5% to $17.89.

Amid volatile geopolitics, investors are seeking safety in base metals like copper and precious metals like gold and silver.

The weaker US dollar is supporting these commodities.

Trading Economics analysts explain:

A softer dollar makes commodities priced in greenbacks, including copper, gold, and silver, more affordable for buyers using other currencies.

The gold price also surged to above US$5,600 per ounce today.

The analysts said:

Momentum picked up after President Trump dismissed the dollar’s slide to four-year lows, signaling tolerance for currency weakness despite ongoing tariff threats and renewed criticism of the Federal Reserve’s independence.

Meantime, the silver price ripped to above US$117 per ounce on the same tailwinds.

Gold is up 29% and silver is up 66% in the year to date.

The post ASX copper shares surge as commodity hits record high appeared first on The Motley Fool Australia.

Should you invest $1,000 in BHP Group right now?

Before you buy BHP Group shares, consider this:

Motley Fool investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and BHP Group wasn’t one of them.

The online investing service he’s run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

And right now, Scott thinks there are 5 stocks that may be better buys…

* Returns as of 1 Jan 2026

.custom-cta-button p {

margin-bottom: 0 !important;

}

More reading

- BHP shares: Should I buy now or wait?

- 3 ASX stocks every Aussie investor should consider in 2026

- Is it time to sell this surging gold producer?

- “A+ Scorecard” – Bell Potter just upgraded this ASX materials stock

- Here are the top 10 ASX 200 shares today

Motley Fool contributor Bronwyn Allen has positions in BHP Group and Global X Copper Miners ETF. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has recommended BHP Group. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

Leave a Reply