ASX 200 mining share Alcoa Corporation CDI (ASX: AAI) is up 1.3% to $93.82 per share on Thursday.

This aluminium stock has had an outstanding run over the past six months.

As the chart below shows, Alcoa shares have streaked 93% higher over that short period.

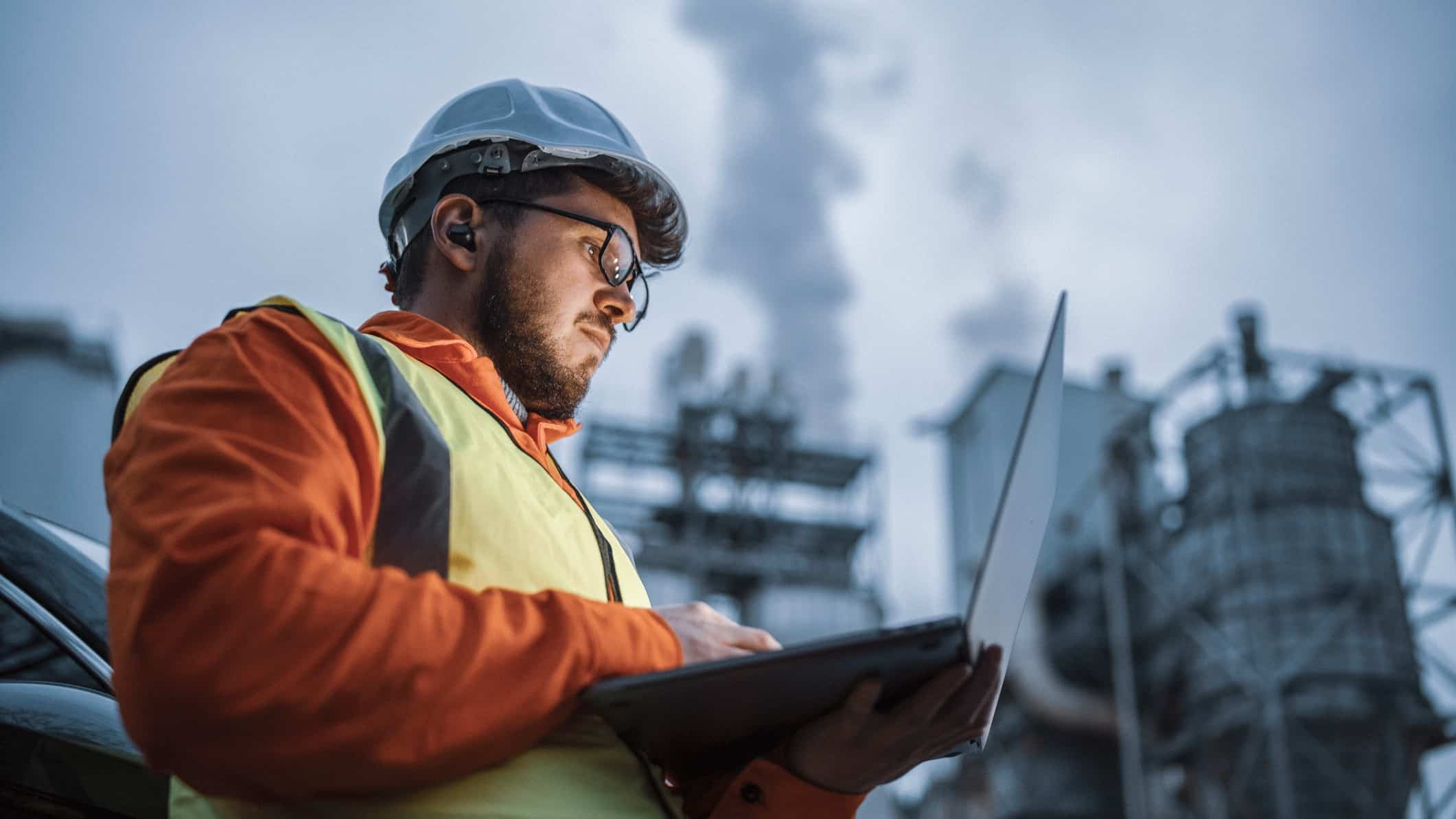

Alcoa produces and sells bauxite, alumina, and aluminium products in the United States, Australia, Spain, Canada, and elsewhere.

The US-based company mines the bauxite, processes it into alumina, and then sells the alumina to smelters and industrial manufacturers.

The company also sells alloy ingot or value-add ingot to producers in the transport, construction, packaging, and wiring segments.

Alcoa also owns hydro power plants that generate electricity, which it sells in the wholesale market to traders, large industrial consumers, and others.

Tomorrow, Alcoa will release its full-year FY25 results.

Before we get a look at the books, let’s consider what’s driving this ASX 200 mining share higher.

What’s powering this ASX 200 mining share’s remarkable surge?

In an article on Forbes.com, investment data analysts at Trefis say Alcoa shares have ripped for three main reasons.

The first is the rising aluminium price.

Aluminium futures are currently trading at three-and-a-half-year highs.

Today, the aluminium price is US$3,119 per tonne, up 6% in a month and 18% year over year.

A number of factors are supporting aluminium futures, including strong demand for renewable energy infrastructure and electric vehicles; aluminium production caps in China, which is the world’s largest producer; and a 50% tariff on imports into the US (with some exceptions).

Trefis commented:

Aluminum is omnipresent in the contemporary economy. It’s an essential material in everything from lightweight automotive structures to aircraft components and green energy infrastructure.

The soaring demand from industries like electric vehicles and data centers â which require large quantities of aluminum for cooling systems and structural elements â has bestowed this metal with a newfound strategic significance not observed since the early 2000’s.

Amid this higher demand, temporary suspensions at key smelters in Iceland, Mozambique, and Australia have lowered global supply.

This has also supported the aluminium price.

Remember Alumina shares?

Alcoa is listed on the New York Stock Exchange as Alcoa Corp (NYSE: AA).

Alcoa Corporation CDIs began trading on the ASX after Alcoa acquired the ASX-listed company, Alumina Limited, in August 2024.

Alumina was a 40% joint venture partner in Alcoa World Alumina and Chemicals (AWAC).

AWAC operates bauxite mines and alumina refineries in Australia and other countries.

As part of the deal, Alumina shareholders received Alcoa CDIs.

Trefis said the second reason this ASX 200 mining share has ripped is strategic company decisions, including buying out Alumina.

They said:

Alcoa is not merely benefiting from a commodity upturn â the company’s financials have exhibited substantial progress.

In the third quarter of 2025, Alcoa disclosed revenues of nearly $3.0 billion and a net income of $232 million, more than double that of the same timeframe a year prior.

This strong performance was bolstered not only by increased aluminum realizations but also by strategic portfolio decisions.

Another strategic decision was Alcoa’s divestment of its stake in the Ma’aden joint venture in July last year.

The analysts said this generated considerable capital gains and strengthened Alcoa’s balance sheet.

These cash inflows have offered flexibility for debt repayment, investments in efficiency upgrades, and support for shareholder returns.

Capital flows out of high-tech and into hard assets

A third factor driving this ASX 200 mining share’s price is more institutional money flowing out of technology and into materials producers.

Alcoa’s surge aligns with a larger trend emerging in 2025â2026: institutional capital is shifting away from high-flying tech stocks and towards hard asset producers â material companies that provide the essential building blocks of the global economy.

Aluminum, copper, and steel manufacturers have all experienced renewed interest as investors reassess inflation, infrastructure spending, and commodity restrictions.

There are other factors driving this redirection of capital.

Trefis said:

This transition … encompasses geopolitical developments, trade regulations, and supply chain adjustments.

Recent tariffs on aluminum and steel, capacity limitations in Asia, and infrastructure reconstructions in certain areas of South America have contributed to a narrative that industrial metals are back in demand.

While the Alcoa share price surge is certainly impressive, with clear tailwinds behind it, Trefis warns of potential risks.

The stock could be susceptible to an increase in global supply, especially from Indonesia, which may add over 1.5 million tons of annual capacity in the coming years.

Concerns about valuations also persist. Current P/E and price-to-book ratios are at elevated levels compared to historical averages, implying that investor enthusiasm might already be factored into stock prices.

The post Why is this ASX 200 mining share up 93% in six months? appeared first on The Motley Fool Australia.

Should you invest $1,000 in Alcoa right now?

Before you buy Alcoa shares, consider this:

Motley Fool investing expert Scott Phillips just revealed what he believes are the 5 best stocks for investors to buy right now… and Alcoa wasn’t one of them.

The online investing service he’s run for over a decade, Motley Fool Share Advisor, has provided thousands of paying members with stock picks that have doubled, tripled or even more.*

And right now, Scott thinks there are 5 stocks that may be better buys…

* Returns as of 1 Jan 2026

.custom-cta-button p {

margin-bottom: 0 !important;

}

More reading

- ASX 200 materials sector outperforms as mining shares continue their ascent

- Gallium has been earmarked as a critical mineral. Here’s how you can get exposure on the ASX

- ASX mining shares on fire! New 52-week highs today

- Red hot: These ASX 200 shares are off to a strong start in 2026

- ASX 200 materials sector dominates as scores of mining shares hit new highs

Motley Fool contributor Bronwyn Allen has positions in Alcoa. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.