from Yahoo Finance https://ift.tt/3eOCi4P

from Yahoo Finance https://ift.tt/3eOCi4P

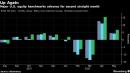

The S&P/ASX 200 Index (ASX: XJO) had an amazing month in May, rising more than 9% for the month. So much for ‘sell in May and go away’.

But as we start a new month and a new season, I think it’s still a time to be very cautious as we climb ever further from the lows we saw ASX 200 shares hit in March.

So here are 3 things that I think we should all look out for this June on the share market.

Of course, this is the primary concern for all investors, as well as all Australians. The share market has been rallying in recent weeks mostly due to the fact that economic restrictions are being lifted in this country as a result of our collective effort to keep the number of coronavirus cases at a minimum.

We have seen just this week that (according to reporting from the Sydney Morning Herald) South Korea has had to re-tighten restrictions after an uptick in coronavirus cases. If this were to occur in Australia (fingers crossed it doesn’t come to this), it would be bad news for ASX shares.

As Reserve Bank of Australia governor Philip Lowe pointed out last week, the damage that the coronavirus has done to our economy hasn’t been as nasty as we all first feared.

Despite this, Dr Lowe also made comments suggesting that government assistance such as the JobKeeper program might have to be expended in order to further insulate the economy. If the government chooses not to go down this path, I think it would be detrimental for the whole economy, and by extension the share market. As such, I think it’s well worth keeping an eye on this space in June.

We don’t like to admit it here in Australia, but the direction of most share markets around the world (including the ASX) is really determined by what’s happening over in the good ol’ United States of America. As the old saying goes, if America sneezes, the rest of the world catches a cold.

Right now, the US government is pumping an extraordinary level of monetary stimulus into the US share markets, which is partly to thank for their (and our) bountiful 2 months of gains since March.

But if things were to go south Stateside, I fear the effects would spill over to our own ASX. Thus, the US is definitely worth watching as we journey into June.

So if you’re keen to keep your eyes on some shares this month, make sure you don’t miss the 5 named below!

NEW. The Motley Fool AU Releases Five Cheap and Good Stocks to Buy for 2020 and beyond!….

Our experts here at The Motley Fool Australia have just released a fantastic report, detailing 5 dirt cheap shares that you can buy in 2020.

One stock is an Australian internet darling with a rock solid reputation and an exciting new business line that promises years (or even decades) of growth… while trading at an ultra-low price…

Another is a diversified conglomerate trading over 40% off its high, all while offering a fully franked dividend yield over 3%…

Plus 3 more cheap bets that could position you to profit over the next 12 months!

See for yourself now. Simply click here or the link below to scoop up your FREE copy and discover all 5 shares. But you will want to hurry – this free report is available for a brief time only.

More reading

Motley Fool contributor Sebastian Bowen has no position in any of the stocks mentioned. The Motley Fool Australia has no position in any of the stocks mentioned. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

The post 3 things that could impact ASX 200 shares this June appeared first on Motley Fool Australia.

from Motley Fool Australia https://ift.tt/3eCIY5G

from Yahoo Finance https://ift.tt/2ZSpKVw

The OneVue Holdings Ltd (ASX: OVH) share price is flying higher this morning, up by as much as 60.42% on the back of a takeover deal by Iress Ltd (ASX: IRE).

OneVue is a provider of superannuation, funds management and investment solutions, supporting financial services by providing technology and service solutions to its clients. It competes with larger ASX players Netwealth Group Ltd (ASX: NWL) and Praemium Ltd (ASX: PSS) in the independent specialist platform space.

This morning, OneVue announced it has entered into a binding scheme implementation agreement with Iress at 40 cents cash per share. This represents a 66.7% premium to OneVue’s last closing price of 24 cents on Thursday.

The agreement remains subject to certain conditions, including an independent expert concluding that the scheme is in the best interest of OneVue shareholders, an ACCC statement that it does not oppose the scheme, and approval by the court.

The OneVue board unanimously recommends that shareholders vote in favour of the scheme if these conditions are satisfied.

Subject to ASIC registration and court approval, the scheme booklet is expected to be distributed to OneVue shareholders in early August 2020. Following this, shareholders will meet to vote on the scheme in early September 2020.

Commenting on the takeover, OneVue managing director Connie Mckeage said:

“We are pleased to have entered into an agreement with Iress to acquire OneVue. The offer represents a significant premium to our current share price and a full cash offer provides compelling certainty for our shareholders. Iress is a company we have significant respect for and we know they are committed to delivering high levels of service to our clients and are looking forward to working more closely alongside our clients and partners.”

Connie Mckeage will play an important role during the transition period and will consult Iress on growth, strategy, and clients after completion.

Explaining the strategic rationale behind the acquisition, Iress chief executive Andrew Walsh said:

“The combination of OneVue’s strength and position in administration of managed funds, superannuation, and investments, with Iress’ strength in software and data will drive innovation through technology. This includes the development of software and services that brings advice and investments closer together, resulting in greater efficiency and productivity for professional advisers and businesses in Australia.”

Iress also announced an equity raising this morning to strengthen its balance sheet and partly fund the $107 million OneVue acquisition.

This will consist of a fully underwritten placement of $150 million to institutional and sophisticated investors, as well as a non-underwritten share purchase plan to raise approximately $20 million. The placement will be conducted at $10.42 per share, representing a 7% discount to Iress’ last closing price of $11.21 on Friday.

5 “Bounce Back” Stocks To Tame The Bear Market (FREE REPORT)

Master investor Scott Phillips has sifted through the wreckage and identified the 5 stocks he thinks could bounce back the hardest once the coronavirus is contained.

Given how far some of them have fallen, the upside potential could be enormous.

The report is called 5 Stocks For Building Wealth after 50, and you can grab a copy for FREE for a limited time only.

But you will have to hurry — history has shown the market could bounce significantly higher before the virus is contained, meaning the cheap prices on offer today might not last for long.

More reading

The post OneVue share price skyrockets 60% after Iress launches $107m takeover offer appeared first on Motley Fool Australia.

from Motley Fool Australia https://ift.tt/36UeVUv

The Afterpay Ltd (ASX: APT) share price has been a hot commodity in 2020. In fact, shares in the buy-now-pay-later leader surged 51.96% last month as investors scrambled to buy in while the S&P/ASX 200 Index (ASX: XJO) jumped 4.22% higher.

The company announced it reached 5 million active customers in the USA during May. Afterpay now has nearly 9 million customers in the US with a 30-40% increase in the weekly run rate from January and February.

More than 15,000 brands now offer, or are in the process of offering, Afterpay to their customers. Afterpay also reported 15 million app and site visits in April 2020 which was good news for shareholders and the company’s share price.

The positive update was just one factor pushing the group’s shares higher. Chinese internet giant Tencent Holdings purchased a 5% stake in the Aussie company for $300 million. This could provide an opening to the lucrative Chinese market for Afterpay in the years ahead.

These were just a couple of the catalysts pushing Afterpay’s value past $12 billion. I also think momentum was a huge contributing factor following on from the strong surge its share price enjoyed in April 2020.

This momentum helped push the Afterpay share price to a new all-time high of $50.01 in May before it closed the month at $47.41 per share. If the strong growth continues in 2020, I can see Afterpay climbing inside the ASX 50 before the year is out.

It’s hard to bet against an ASX 200 share that is up 435% since 23 March. However, the Afterpay share price is hot property right now and I think it could be dislocated from fundamentals.

This means I see Afterpay as a speculative buy. It could provide great growth potential and be a strong share to buy in 2020. However, there is still competition and regulatory risk that threaten Afterpay’s potential growth.

If you feel the Afterpay share price is too expensive to buy right now, here are 5 good and cheap ASX shares to buy instead!

NEW. The Motley Fool AU Releases Five Cheap and Good Stocks to Buy for 2020 and beyond!….

Our experts here at The Motley Fool Australia have just released a fantastic report, detailing 5 dirt cheap shares that you can buy in 2020.

One stock is an Australian internet darling with a rock solid reputation and an exciting new business line that promises years (or even decades) of growth… while trading at an ultra-low price…

Another is a diversified conglomerate trading over 40% off its high, all while offering a fully franked dividend yield over 3%…

Plus 3 more cheap bets that could position you to profit over the next 12 months!

See for yourself now. Simply click here or the link below to scoop up your FREE copy and discover all 5 shares. But you will want to hurry – this free report is available for a brief time only.

More reading

Ken Hall has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. owns shares of Xero. The Motley Fool Australia owns shares of AFTERPAY T FPO. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

The post Afterpay share price rockets 50% in May, is it in the buy zone? appeared first on Motley Fool Australia.

from Motley Fool Australia https://ift.tt/3cgn8TX

S&P/ASX 200 Index (ASX: XJO) investors in retirement will likely need dividend income to live off. Along with this, a priority should be protecting capital and de-risking your portfolio. However, it is important not to lose sight of the magical power of compounding at high rates of return. In my opinion, all ASX investors should target the maximum total return they can achieve for their risk profile.

As investors, we’re a motley crew. We all have motley goals, motley resources and motley risk appetite. Because of this, it is important to understand your own personal circumstances and invest accordingly. The below ASX stocks will be fantastic options for most investors in retirement, but not for all.

I am a big fan of writing everything down so that you can refer back to your notes. Take the time to think about what you want to achieve by investing in ASX stocks. It will be much clearer if the following stocks are for you.

Duxton Water Ltd (ASX: D2O)

Duxton Water is an alternative business, betting on the long-term value of water entitlements in Australia. The company owns a number of entitlements in various regions and leases these out to the agriculture industry. Management has forecast that the dividend can grow every 6 months for the next 2 years.

Duxton is priced at a large discount to its monthly net tangible assets (NTA). At current prices, the stock should be able to weather more rain in the short term. Over the long term, the scarcity and price of water is expected to rise.

Duxton has a dividend yield of 4% or 5.7% grossed-up.

Vanguard Australian Shares High Yield ETF (ASX: VHY)

This ETF holds a basket of 62 of the ASX’s best dividend-paying stocks. The composition of holdings has changed recently in line with market and economic conditions. The ETF has sold down the banks in order to buy more reliable dividend stocks.

Two of the top holdings now include BHP Group Ltd (ASX: BHP) and Wesfarmers Ltd (ASX: WES). Given the large number of delayed payments and cancelled dividends, a forward dividend estimate is more reliable than a trailing yield. Vanguard estimates a forward yield of 6.2% or 8.48% grossed-up.

Macquarie Group Ltd (ASX: MQG)

Macquarie may perform better than the other big ASX banks given its diversified operations. The group has significant operations in investment banking and asset management. Investment banking is often the most profitable during downturns, where there is a lot of capital raising and takeovers.

For FY21, Macquarie offers investors an estimated 3.91% partially franked dividend yield.

Retirement is an opportunity to benefit from all your hard work and sacrifices. Selling down a portion of your portfolio in high-valued markets, mixed with taking dividends in cash during bear markets is a great way to fund your lifestyle as an investor in retirement.

Here are some other high quality stocks for retirement.

NEW: Expert names top dividend stock for 2020 (free report)

When our resident dividend expert Edward Vesely has a stock tip, it can pay to listen. After all, he’s the investing genius that runs Motley Fool Dividend Investor, the newsletter service that has picked huge winners like Dicker Data (+92%), SDI Limited (+53%) and National Storage (+35%).*

Edward has just named what he believes is the number one ASX dividend stock to buy for 2020.

This fully franked “under the radar” company is currently trading more than 24% below its all-time high and paying a 6.7% grossed-up dividend.

The name of this dividend dynamo and the full investment case is revealed in this brand new free report.

But you will have to hurry — history has shown it can pay dividends to get in early to some of Edward’s stock picks, and this dividend stock is already on the move.

More reading

Motley Fool contributor Lloyd Prout has no position in any of the stocks mentioned. The Motley Fool Australia owns shares of and has recommended Macquarie Group Limited. The Motley Fool Australia owns shares of Wesfarmers Limited. The Motley Fool Australia has recommended DUXTON FPO. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

The post 3 best stocks for ASX 200 investors in retirement to buy now appeared first on Motley Fool Australia.

from Motley Fool Australia https://ift.tt/2XlaH5i

In late morning trade the S&P/ASX 200 Index (ASX: XJO) has bounced back from a poor start and is pushing higher. At the time of writing the benchmark index is up 0.25% to 5,770.9 points.

Four shares that are climbing more than most today are listed below. Here’s why they are charging higher:

The Austal Limited (ASX: ASB) share price is up over 5% to $3.52. Investors have been buying the shipbuilder’s shares after it upgraded its FY 2020 guidance at the end of last week. One broker that has responded positively to this upgrade was Citi. This morning the broker retained its buy rating and lifted the price target on Austal’s shares to $4.05.

The CSL Limited (ASX: CSL) share price is up 3% to $284.46. Investors appear to be taking advantage of the biotherapeutics company’s recent share price weakness to top up positions. Even after today’s gain, CSL’s shares are down 17% from their 52-week high. Concerns over the pandemic’s impact on plasma collections has been weighing on the company’s shares.

The Fortescue Metals Group Limited (ASX: FMG) share price is up 3% to $14.30. The catalyst for this gain has been a jump in iron ore prices on Friday night. The spot benchmark iron ore price climbed above US$100 a tonne amid concerns over supply disruptions in Brazil because of the pandemic. According to CommSec, iron ore rose by US$4.50 or 4.7% on Friday to US$100.90 a tonne.

The Star Entertainment Group Ltd (ASX: SGR) share price has stormed almost 6% higher to $3.12. This follows the release of two announcements on Monday by the casino and resorts operator. The first was a new long-term gaming tax agreement with the New South Wales government. The other was the announcement that its Star Sydney business will reopen today. This will see private gaming rooms open and up to 12 food and beverage venues within the complex.

Missed out on these gains? Then don’t miss out on these dirt cheap shares before they rebound…

NEW. The Motley Fool AU Releases Five Cheap and Good Stocks to Buy for 2020 and beyond!….

Our experts here at The Motley Fool Australia have just released a fantastic report, detailing 5 dirt cheap shares that you can buy in 2020.

One stock is an Australian internet darling with a rock solid reputation and an exciting new business line that promises years (or even decades) of growth… while trading at an ultra-low price…

Another is a diversified conglomerate trading over 40% off its high, all while offering a fully franked dividend yield over 3%…

Plus 3 more cheap bets that could position you to profit over the next 12 months!

See for yourself now. Simply click here or the link below to scoop up your FREE copy and discover all 5 shares. But you will want to hurry – this free report is available for a brief time only.

More reading

James Mickleboro has no position in any of the stocks mentioned. The Motley Fool Australia’s parent company Motley Fool Holdings Inc. owns shares of Austal Limited and CSL Ltd. The Motley Fool Australia has no position in any of the stocks mentioned. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

The post Why Austal, CSL, Fortescue, & Star shares are charging higher today appeared first on Motley Fool Australia.

from Motley Fool Australia https://ift.tt/3cm52Qo

May.31 — The Chinese and Hong Kong governments are pushing back are pushing back against the United States after President Donald Trump said he would remove special trading privileges that the U.S. gives to Hong Kong. Beijing says Trump’s actions are doomed to fail and that Hong Kong says it’s not worried about losing the favorable trade rules. Bloomberg’s Stephen Engle reports on “Bloomberg Daybreak: Asia.”

May.31 — The Chinese and Hong Kong governments are pushing back are pushing back against the United States after President Donald Trump said he would remove special trading privileges that the U.S. gives to Hong Kong. Beijing says Trump’s actions are doomed to fail and that Hong Kong says it’s not worried about losing the favorable trade rules. Bloomberg’s Stephen Engle reports on “Bloomberg Daybreak: Asia.”

from Yahoo Finance https://ift.tt/3dy1qMZ

Last Friday, 3 S&P/ASX 200 Index (ASX: XJO) blue-chip shares were included in the MCSI Australia Index. These were Afterpay Ltd (ASX: APT), Evolution Mining Ltd (ASX: EVN) and Northern Star Resources Ltd (ASX: NST). Notably, 2 of the 3 inclusions came from the gold mining sector.

Once a share is included in an MCSI index it is automatically added to the portfolios of EFTs tracking that index. One example is the Vanguard MSCI Australian Large Companies Index ETF (ASX: VLF). With billions of dollars in play, any small change can cause large scale ripples.

Last week, all 3 companies saw their share prices rise considerably from a mid-week low point. In my opinion, they are positioned to enjoy a continued rise in share prices this week.

Afterpay is the most prominent and reported on ASX 200 share today. It is nothing short of a phenomenon. Last week, the company’s share price rose 4.98% from its low on Wednesday to Friday’s close. The current Afterpay valuation is a point of contention among investors. Nonetheless, its position as a growth share is clear.

Northern Star has been the best growth share on the ASX 200 over the past 10 years. An initial investment on 1 January 2010 would have grown an amazing 490 times so far. From Wednesday’s low to Friday’s close last week, the Northern Star share price rose by 10.83%.

The company is known for increasing the gold reserves and production output of mines it acquires. It recently purchased 5% of the Kalgoorlie super pit mine site. This included the operating rights. In my opinion, it set to continue its share price rise.

Evolution Mining is another Australian blue chip gold miner that is known for its productivity. Its most recent acquisition, Red Lake, is likely to see an improvement in productivity. Evolution shares rose 10.37% from their low point on Wednesday last week to Friday’s close.

In addition, 8 companies were dropped into the MSCI World Small Cap Index. These were Alumina Limited (ASX: AWC), Bendigo and Adelaide Bank Ltd (ASX: BEN), Boral Limited (ASX: BLD), Challenger Ltd (ASX: CGF), Flight Centre Travel Group Ltd (ASX: FLT), Harvey Norman Holdings Limited (ASX: HVN), Incitec Pivot Ltd (ASX: IPL), and Worley Ltd (ASX: WOR).

Make sure to download our free report on 5 cheap shares for growing wealth.

NEW. The Motley Fool AU Releases Five Cheap and Good Stocks to Buy for 2020 and beyond!….

Our experts here at The Motley Fool Australia have just released a fantastic report, detailing 5 dirt cheap shares that you can buy in 2020.

One stock is an Australian internet darling with a rock solid reputation and an exciting new business line that promises years (or even decades) of growth… while trading at an ultra-low price…

Another is a diversified conglomerate trading over 40% off its high, all while offering a fully franked dividend yield over 3%…

Plus 3 more cheap bets that could position you to profit over the next 12 months!

See for yourself now. Simply click here or the link below to scoop up your FREE copy and discover all 5 shares. But you will want to hurry – this free report is available for a brief time only.

More reading

Motley Fool contributor Daryl Mather has no position in any of the stocks mentioned. The Motley Fool Australia owns shares of and has recommended Challenger Limited. The Motley Fool Australia owns shares of AFTERPAY T FPO. The Motley Fool Australia has recommended Flight Centre Travel Group Limited. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy. This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips.

The post Why these 3 ASX 200 blue chips could be set for growth this week appeared first on Motley Fool Australia.

from Motley Fool Australia https://ift.tt/2ZWsxxc

from Yahoo Finance https://ift.tt/2Xja4sH