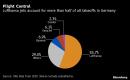

(Bloomberg) — Deutsche Lufthansa AG may have won its battle for state aid, but its surrender of airport slots to appease regulators heralds heightened conflict between European aviation’s old guard and low-cost challengers.A rivalry that’s been simmering for years has been given fresh impetus by the coronavirus crisis, with former flag carriers falling back on government support as discounters including Ryanair Holdings Plc and Wizz Air Holdings Plc argue that the market alone should dictate who survives.Lufthansa’s 9 billion-euro ($9.9 billion) bailout and a slots accord with the European Union overnight Friday handed the region’s biggest airline a lifeline. Now, the German group and network carriers such as Air France-KLM face a battle royale in repelling no-frills operators that came into the crisis stronger and plan to use it to gain ground in territories hitherto largely closed to them.“We are trying to take advantage of the situation,” Wizz Chief Executive Officer Jozsef Varadi said in an interview. “Lufthansa is getting a huge financial edge, but they’ll need to restructure after taking all of this money. So Germany will bring opportunities.”Aid ImbalanceDiscount airlines have received only modest support compared with legacy carriers. Ryanair, Wizz and EasyJet Plc have tapped the U.K.’s Covid Corporate Financing Facility for a combined 1.5 billion pounds ($1.8 billion), while Air France-KLM has received 7 billion euros from the French state and could overtake Lufthansa’s bailout once Dutch support is finalized.Low-cost carriers have also been quicker off the mark in slashing costs, with Ryanair, which has its biggest base at London Stansted, announcing 3,000 job cuts a month ago when Lufthansa was still in the early stages of putting together its bailout request.The strength of the challenge to Lufthansa in particular will depend on take-up for the 12 pairs of daily flight slots to be made available to competitors at its Frankfurt and Munich hubs as part of the bailout settlement ordered by the EU. Complicating matters is a proviso that says only new entrants can obtain the takeoff and landing rights during the first 18 months.Market DistortionThat would allow Ryanair, which has flights in Frankfurt, to target Munich, and EasyJet to do the reverse. Budapest-based Wizz, Europe’s third-biggest discount carrier, doesn’t currently serve either airport so could seek slots at both.Spokespeople for Ryanair and EasyJet declined to comment.Read more:Germany, Lufthansa Prove Tougher Foes for Vestager Than GoogleMerkel Is Seizing Her Chance to Revolutionize Germany’s EconomyWe All Might Be Flying in Planes Again Soon: Chris BryantRyanair gained 4.8% as of 11:18 a.m. in Dublin, while EasyJet advanced 4.4% and Wizz was up 3.8% in London. Lufthansa added 5.4% on Tradegate with regular trading in Frankfurt closed for a German holiday.The biggest opportunities for the low-cost players lie in Germany, Italy and Norway, said Mark Manduca, an analyst with Citigroup.“After the crisis passes and a price war this summer ensues, Ryanair and Wizz stand on the cusp of a three- to five-year consolidation and expansion story, as the participants around them shrink and flounder,” he said in a research note.State aid to the likes of Lufthansa will at least initially bend the market in their favor, EU competition watchdog Margrethe Vestager said in an interview with Bloomberg TV. “This is why we also have remedies, to try to limit that market distortion,” she said.The Lufthansa case is a template for EU oversight of other virus-related recapitalizations, Vestager said. The bloc would likely review any equity injection into Air France-KLM by France or the Netherlands, and is in close contact with the Italian government over the nationalization of bankrupt Alitalia Spa, which she called “a special case” because of its pre-existing financial distress.That budget airlines will make inroads isn’t a given.In Germany, the major hubs of Frankfurt and Munich charge typically higher fees than at the smaller airports traditional favored by discount operators, something Varadi said is a major obstacle to flying there.Both have a large proportion of passengers who transfer on or off long-distance flights, limiting the market share available to short-haul carriers.Stationing staff in Germany also means grappling with stringent employment laws and powerful unions, potential headaches for companies seeking to keep expenses low.Lufthansa’s pilot, cabin-crew and ground-crew unions wrote to European Commission President Ursula von Der Leyen on Friday saying that a shift of slots to discount carriers would cause a “massive hollowing out” of labor standards and pay.Disruption AheadThe French market could open up as Air France-KLM reins in its network in response to environmental demands from the French government. A restructuring to be presented within months will call for a 40% cut in domestic French capacity by the end of 2021, Chief Executive Officer Ben Smith told shareholders last week.The company has also said it may raise new equity, potentially triggering EU scrutiny that could lead to slots being made available in the busy Paris and Amsterdam markets. The initial funding package avoided increasing state holdings amid acrimony between the French and Dutch governments over existing stakes.In Italy, Alitalia was in bankruptcy protection even before the virus hit. The rescue is regarded as dubious given the airline’s status, and the EU is expected to begin an investigation. Slot availability in Rome and Milan could be one outcome.Full-service airlines are also in retreat in the U.K., where British Airways and Virgin Atlantic Airways Ltd. have indicated they’ll exit London Gatwick airport to consolidate operations at the city’s Heathrow hub.That will consolidate Gatwick’s status as a discount and leisure-oriented base, leaving EasyJet unchallenged as the biggest operator and offering an opportunity for Ryanair and Wizz to expand their more modest presence.Discount airlines are also cutting their cloth, though not nearly so much.Wizz will maintain all of its European bases and routes, while trimming frequencies, Varadi said. It announced four new hubs and 50 new routes on Friday.“We’re sensing strong demand, which we aim to tap as travel restrictions ease,” the CEO said.(Updates with Vestager comments in 12th paragraph)For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.

(Bloomberg) — Deutsche Lufthansa AG may have won its battle for state aid, but its surrender of airport slots to appease regulators heralds heightened conflict between European aviation’s old guard and low-cost challengers.A rivalry that’s been simmering for years has been given fresh impetus by the coronavirus crisis, with former flag carriers falling back on government support as discounters including Ryanair Holdings Plc and Wizz Air Holdings Plc argue that the market alone should dictate who survives.Lufthansa’s 9 billion-euro ($9.9 billion) bailout and a slots accord with the European Union overnight Friday handed the region’s biggest airline a lifeline. Now, the German group and network carriers such as Air France-KLM face a battle royale in repelling no-frills operators that came into the crisis stronger and plan to use it to gain ground in territories hitherto largely closed to them.“We are trying to take advantage of the situation,” Wizz Chief Executive Officer Jozsef Varadi said in an interview. “Lufthansa is getting a huge financial edge, but they’ll need to restructure after taking all of this money. So Germany will bring opportunities.”Aid ImbalanceDiscount airlines have received only modest support compared with legacy carriers. Ryanair, Wizz and EasyJet Plc have tapped the U.K.’s Covid Corporate Financing Facility for a combined 1.5 billion pounds ($1.8 billion), while Air France-KLM has received 7 billion euros from the French state and could overtake Lufthansa’s bailout once Dutch support is finalized.Low-cost carriers have also been quicker off the mark in slashing costs, with Ryanair, which has its biggest base at London Stansted, announcing 3,000 job cuts a month ago when Lufthansa was still in the early stages of putting together its bailout request.The strength of the challenge to Lufthansa in particular will depend on take-up for the 12 pairs of daily flight slots to be made available to competitors at its Frankfurt and Munich hubs as part of the bailout settlement ordered by the EU. Complicating matters is a proviso that says only new entrants can obtain the takeoff and landing rights during the first 18 months.Market DistortionThat would allow Ryanair, which has flights in Frankfurt, to target Munich, and EasyJet to do the reverse. Budapest-based Wizz, Europe’s third-biggest discount carrier, doesn’t currently serve either airport so could seek slots at both.Spokespeople for Ryanair and EasyJet declined to comment.Read more:Germany, Lufthansa Prove Tougher Foes for Vestager Than GoogleMerkel Is Seizing Her Chance to Revolutionize Germany’s EconomyWe All Might Be Flying in Planes Again Soon: Chris BryantRyanair gained 4.8% as of 11:18 a.m. in Dublin, while EasyJet advanced 4.4% and Wizz was up 3.8% in London. Lufthansa added 5.4% on Tradegate with regular trading in Frankfurt closed for a German holiday.The biggest opportunities for the low-cost players lie in Germany, Italy and Norway, said Mark Manduca, an analyst with Citigroup.“After the crisis passes and a price war this summer ensues, Ryanair and Wizz stand on the cusp of a three- to five-year consolidation and expansion story, as the participants around them shrink and flounder,” he said in a research note.State aid to the likes of Lufthansa will at least initially bend the market in their favor, EU competition watchdog Margrethe Vestager said in an interview with Bloomberg TV. “This is why we also have remedies, to try to limit that market distortion,” she said.The Lufthansa case is a template for EU oversight of other virus-related recapitalizations, Vestager said. The bloc would likely review any equity injection into Air France-KLM by France or the Netherlands, and is in close contact with the Italian government over the nationalization of bankrupt Alitalia Spa, which she called “a special case” because of its pre-existing financial distress.That budget airlines will make inroads isn’t a given.In Germany, the major hubs of Frankfurt and Munich charge typically higher fees than at the smaller airports traditional favored by discount operators, something Varadi said is a major obstacle to flying there.Both have a large proportion of passengers who transfer on or off long-distance flights, limiting the market share available to short-haul carriers.Stationing staff in Germany also means grappling with stringent employment laws and powerful unions, potential headaches for companies seeking to keep expenses low.Lufthansa’s pilot, cabin-crew and ground-crew unions wrote to European Commission President Ursula von Der Leyen on Friday saying that a shift of slots to discount carriers would cause a “massive hollowing out” of labor standards and pay.Disruption AheadThe French market could open up as Air France-KLM reins in its network in response to environmental demands from the French government. A restructuring to be presented within months will call for a 40% cut in domestic French capacity by the end of 2021, Chief Executive Officer Ben Smith told shareholders last week.The company has also said it may raise new equity, potentially triggering EU scrutiny that could lead to slots being made available in the busy Paris and Amsterdam markets. The initial funding package avoided increasing state holdings amid acrimony between the French and Dutch governments over existing stakes.In Italy, Alitalia was in bankruptcy protection even before the virus hit. The rescue is regarded as dubious given the airline’s status, and the EU is expected to begin an investigation. Slot availability in Rome and Milan could be one outcome.Full-service airlines are also in retreat in the U.K., where British Airways and Virgin Atlantic Airways Ltd. have indicated they’ll exit London Gatwick airport to consolidate operations at the city’s Heathrow hub.That will consolidate Gatwick’s status as a discount and leisure-oriented base, leaving EasyJet unchallenged as the biggest operator and offering an opportunity for Ryanair and Wizz to expand their more modest presence.Discount airlines are also cutting their cloth, though not nearly so much.Wizz will maintain all of its European bases and routes, while trimming frequencies, Varadi said. It announced four new hubs and 50 new routes on Friday.“We’re sensing strong demand, which we aim to tap as travel restrictions ease,” the CEO said.(Updates with Vestager comments in 12th paragraph)For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.

from Yahoo Finance https://ift.tt/3gHc6e2